- MVP Money Moves

- Posts

- Is The American Dream Dying? U.S. Retirement Crisis & How Gen X, Millennials & Gen Z Can Rewrite It

Is The American Dream Dying? U.S. Retirement Crisis & How Gen X, Millennials & Gen Z Can Rewrite It

For the first time in U.S. history, only about 50% of children earn more than their parents, down from nearly 90% for those born in the 1940s (Opportunity Insights). That’s a turning point no one saw coming—and it signals that the American Dream may be dead. The dream to earn more, retire comfortably, and own a home has collapsed under stagnant wages, soaring debt, and unaffordable housing.

But here’s the kicker: your retirement doesn’t have to follow that fate.

Why the American Dream Is Fading—and How It Ties to the Retirement Crisis

🔻 Declining Mobility & Income Stagnation

Only 50% of children today surpass their parents’ earnings, compared to 90% for those born in the 1940s (Opportunity Insights).

The belief in the Dream is collapsing: only ~40% of adults under 50 believe upward mobility through hard work is still possible (Pew Research).

Flat or declining income directly undermines saving for a long retirement. Gen X, Millennials, and Gen Z are feeling it most.

🏠 Homeownership Slipping Away

First‑time homebuyer rates dropped from 50% in 2010 to just 24% in 2024 (Business Insider).

Owning a home has traditionally been a core path to wealth, so losing it dims retirement prospects.

⚖️ Is the American Dream Really Dead? A Counterpoint

While statistics paint a grim picture, some experts argue the American Dream isn’t dead—just evolving.

Upward Mobility Still Exists Regionally: Areas in the Midwest and Mountain West still show strong mobility rates, driven by community networks and growing local economies (Opportunity Insights).

Wage Growth is Recovering: In 2023–2024, wages in several industries—especially tech, trades, and healthcare—outpaced inflation, boosting younger skilled workers (BLS).

Homeownership Isn’t Gone, It’s Delayed: Millennials and Gen Z are buying homes later, but ownership rates for adults over 40 remain close to historical averages, suggesting the Dream may be postponed rather than lost (Urban Institute).

New Wealth Paths Are Emerging: Low-cost ETFs, fractional share investing, and digital entrepreneurship open wealth-building opportunities that previous generations didn’t have.

The Takeaway

The traditional Dream — a steady job, pension, and house in your 30s — may be gone. But a new dream is forming, a kind of ‘New Gold Dream,’ to borrow from Simple Minds: one built on flexibility, tech-driven income, and global investing opportunities waiting for those ready to seize them.

The real question: “Will you rewrite it for today’s world, or cling to a version that no longer exists?”

How This Impacts Each Generation’s Retirement Future

Gen X: The Last to Fight for the Dream

Median savings near $40,000: A 2023 NIRS report found the typical Gen X household has only about $40,000 in retirement accounts (Source).

Low confidence: Just 14% of Gen X have a defined-benefit pension, and ~62% feel confident about retirement, while a small sliver (14%) believe they’re financially prepared (Source).

Millennials: The Debt Generation

According to Bankrate’s 2025 Credit Card Debt Report, 49% of millennials (ages 29–44) with credit cards carry a balance from month to month—making them one of the highest-debt groups, surpassed only slightly by Gen X (55%) and ahead of Boomers (44%) and Gen Z (35%) (Source).

A Brookings analysis shows that in 2016, Millennial households aged 25–34 had 12% less median wealth than the same age group did in 1989 and about 25% less median wealth than Gen X did at a similar age (Source).

Gen Z: A Tough Inheritance, but More Time

Over 50% expect to earn less than their parents (Opportunity Insights); just 24% are first-time buyers (Business Insider).

But auto-enrollment in 401(k)s and early investing habits mean Gen Z could outpace older generations—if they stay consistent.

🚀 Why the Next 20 Years Could Be the Most Exciting of Your Life

Even with today’s challenges, the future is full of opportunity. Here are a few transformations that could be on the horizon:

AI-Powered Tools

AI will “unlock productivity and innovation,” creating jobs and democratizing investing—opening a growing universe of strategies, tools, and asset classes (McKinsey).

Healthcare & Longevity

AI-driven drug design and genomics could push lifespans toward 120 years (WEF).

A projected $8 trillion longevity market means healthier aging and reduced retirement costs.

Clean Energy & Climate Pragmatism

Larry Fink, CEO of BlackRock predicts trillions in green infrastructure will create jobs and steady long-term returns (BlackRock).

Space: The New Industrial Frontier

Space manufacturing is being described as the “next industrial revolution.” Thanks to reusable rockets, launch costs have plummeted—from over $2,000/kg to as low as $100–$200/kg for SpaceX’s Starship, making orbital industries like semiconductor fabrication, pharmaceuticals, and solar manufacturing possible in space (RealClearDefense, NextBigFuture).

Global Engagement & Stability

Nouriel Roubini projects U.S. GDP growth near 4% by 2030, powered by AI, robotics, and biotech (Business Insider).

The $84 Trillion Wealth Transfer

By 2045, Baby Boomers will pass down $84 trillion, opening chances for homeownership, business funding, and early retirement (Fortune).

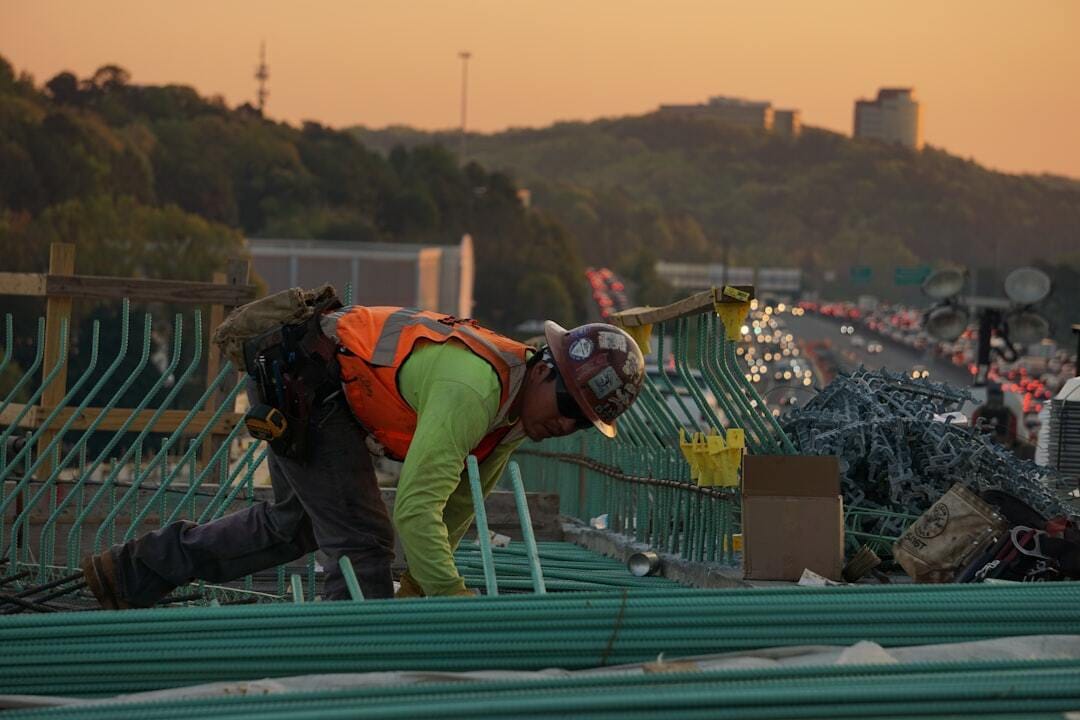

Skilled Trades: The Overlooked Gold Rush

While AI and space tech grab headlines, skilled trades are quietly entering a golden era.

The retirement wave among Boomers is leaving critical shortages in electricians, welders, HVAC specialists, and plumbers.

Green infrastructure buildouts—from EV charging stations to solar panels—are fueling demand for highly paid tradespeople.

Many skilled trades already earn $70,000–$100,000 annually, often without requiring a four-year degree.

Electrician jobs are projected to grow 11% from 2023 to 2033, far outpacing the 4% average for all U.S. occupations. The median wage was $62,350 in May 2024, with top earners surpassing $106,030 annually (BLS).

Why this matters:

For Gen X looking to pivot careers, Millennials seeking stability, or Gen Z exploring alternatives to college debt, trades represent a fast-track to financial security—and they align directly with the clean energy boom.

The Retirement Battle Plan: How to Reclaim Your Dream

With the American Dream under threat, here’s how each generation can rewrite their story:

✅ General Strategies for All Generations

Start Saving Now—No Matter Your Age

Time is your most powerful asset. Even small amounts invested consistently benefit from compounding growth.Invest Wisely, Not Passively

Cash loses value over time. A diversified portfolio—index funds, target-date funds—can help combat inflation and build growth.Open an IRA if No Workplace Plan Exists

Even a $50/month Roth IRA started early can result in six-figure savings by retirement.Pay Down High-Interest Debt While Saving

Use strategies like debt snowball or avalanche—but ensure you still capture any employer match contributions.Build an Emergency Fund

Avoid tapping retirement savings for emergencies. A separate 3–6 month fund prevents derailment.Plan Your Social Security Strategy

Delaying benefits boosts monthly payments. Claiming later can mean a stronger financial base for your later years.

🎯 Gen X Specific Moves (Born 1965–1980)

Max Out Catch-Up Contributions ($7,500 extra)

Research shows that postponing retirement from age 62 to 66 can increase a retiree’s income by roughly 33%, thanks to extra savings, investment returns, shortened payout period, and delayed Social Security benefits (SSA).

Apply the “Go for No” Mindset: If saving more seems impossible, push back—ask “What if I aim for just 1% more?” Odds are, you'll do it.

🎯 Millennial-Specific Moves (Born 1981–1996)

Automate 401(k) Contributions: Aim for 10–15% of income. Employer matches are free money.

Use New SECURE Act Benefits: Some employers now match student loan payments—check if yours does.

Refinance or Consolidate Debt: Lower rates free up cash for retirement.

Embrace Roth IRAs: Millennials are in lower brackets—Roth contributions now mean tax-free retirement savings later.

🎯 Gen Z-Specific Moves (Born 1997–2012)

Invest Early in Stock-Focused Funds: Momentum counts—growth early pays off.

Track and Automate Savings: Even small monthly payments translate into major gains over decades.

Avoid 401(k) Cash-Outs When Job-Hopping: Roll over funds to keep compounding working.

Redefine the Dream: Focus on financial freedom and life purpose, not just material benchmarks.

FAQs

❓ Is the American Dream truly dead?

It’s changing. Traditional routes like homeownership and pensions are harder, but new paths—investing, digital entrepreneurship, and even “rent and invest the difference” strategies—can build financial success.

Instead of stretching for an overpriced mortgage, some choose to rent and invest the gap between their rent and what a mortgage payment would cost. Here’s why that can work:

Historical home value growth: U.S. home prices have averaged 4–5% nominal annual growth (~0.5–1% after inflation) since the 1970s (FRED/BIS data).

Stock market returns: The S&P 500 has averaged ~10.5% annual nominal returns since 1957 (~6–7% after inflation), far outpacing long-term real estate returns (Investopedia).

If you’re disciplined enough to invest the difference (and not spend it), stocks and diversified portfolios can potentially build wealth faster than relying solely on home equity.

That said, homeownership still offers forced savings, inflation protection, and stability, making it valuable for those seeking security over pure returns. The best choice depends on your goals, time horizon, and financial discipline.

❓ Can I rely on Social Security?

Don't count on full benefits. Treat it as a supplement, not your foundation.

❓ What if I can’t pay down debt and save?

Start small. Automate $25 or $50. Small steps build big results over time.

🔚 Conclusion: A New American Dream Is Emerging

The old Dream may be fading, but a new one is yours to build—start today, invest smartly, and create the future you deserve.

📩 Stay in the know with smart investment strategies, real success stories, and practical tips—designed for athletes, women investors, adults with ADHD, and anyone navigating major life changes like retirement or inheritance.

Subscribe to the newsletter and get insights that help you make confident money moves.

✅ Know someone who’d benefit? Share the blog with a friend or family member—we’re grateful for your support as we grow our community.

IG 📸 @mvpmoneymoves

Want more info on this topic? Have a blog suggestion? Connect with us.

All information provided within this blog is for information, entertainment, education, or illustrative purposes only. The information is not intended to be and does not constitute financial advice or any other advice that is general in nature and is not specific to you. None of the information is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security or company. All data has been taken from sources believed to be reliable and cannot be guaranteed. Any performance data shown in our illustrations and analytics may be hypothetical. Hypothetical results have certain inherent limitations. Past performance is not indicative of future results. All investments involve risk, including the possible loss of principal. Blog posts may utilize the assistance of large language models and, therefore, may at times contain erroneous data or statements. The newsletter uses content from third parties, and such parties' views don't necessarily reflect the views of the newsletter. The accuracy or reliability of third-party content or links to the content is not verified or guaranteed. Reposted or linked material is not an endorsement.

Reply